The current ratio and quick ratio (also known as the acid-test ratio) are both financial ratios that measure a company’s ability to pay off its short-term obligations. While both ratios are similar, there are some key differences between them. Decreased current assets such as cash, accounts receivable, and inventory can lower the current ratio. This can happen if the company is experiencing lower sales or cannot collect payments from customers promptly. In addition, it is crucial to consider the industry in which a company operates when evaluating its current ratio. Some industries, such as retail, may have higher current ratios due to their high inventory levels.

Current Liabilities

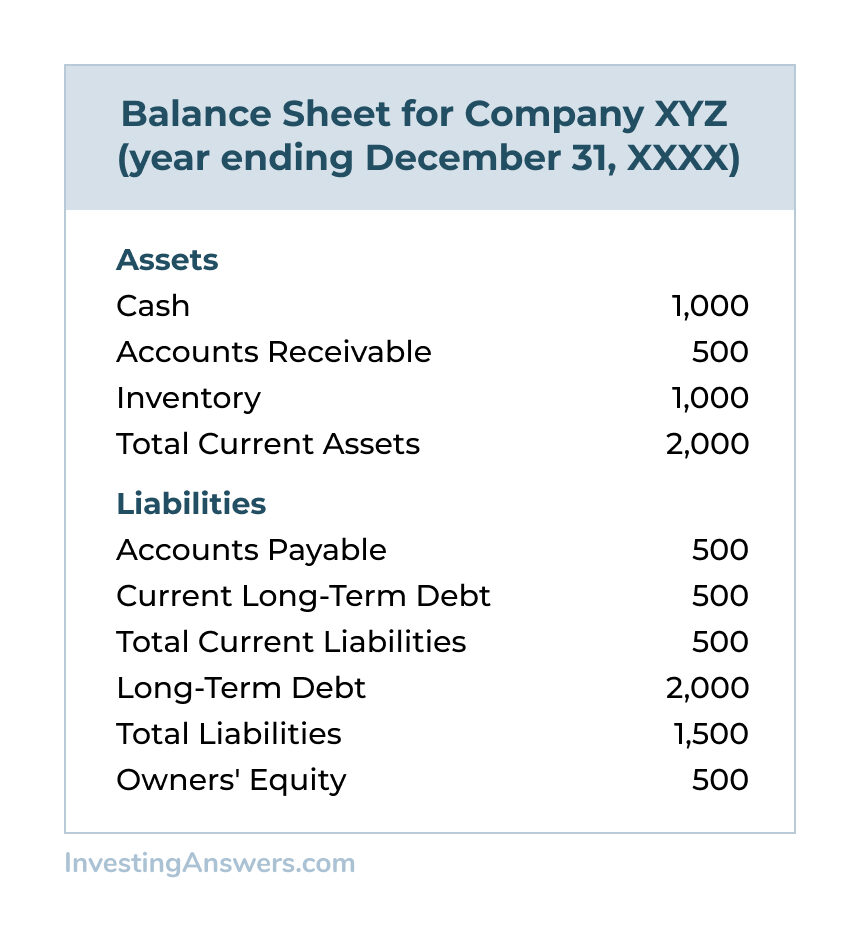

These typically include cash on hand, accounts receivable, and inventory. It represents the funds a company can access swiftly to settle short-term obligations. If a company has $500,000 in current assets and $250,000 in current liabilities, its Current Ratio is 2 ($500,000 / $250,000), indicating that it has twice the assets to cover its immediate obligations.

- A low current ratio may indicate a company’s difficulty meeting its short-term obligations, which can be a red flag for investors and stakeholders.

- It’s ideal to use several metrics, such as the quick and current ratios, profit margins, and historical trends, to get a clear picture of a company’s status.

- The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis).

- Ironically, the industry that extends more credit actually may have a superficially stronger current ratio because its current assets would be higher.

Not Considering The Company’s Strategy – Mistakes Companies Make When Analyzing Their Current Ratio

A current ratio of less than 1.00 may seem alarming, but a single ratio doesn’t always offer a complete picture of a company’s finances. Standard costing has been a foundational tool in cost accounting for decades, helping businesses set predetermined costs for products and measure variances against actual costs. Once you have determined your asset and liability totals, calculating the current ratio in Excel is very straightforward, even without a template.

Nature of the Business – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management. From the above table, it is pretty clear that company C has $2.22 of Current Assets for each $1.0 of its liabilities. Company C is more liquid and is better positioned to pay off its liabilities. The interpretation of the value of the current ratio (working capital ratio) is quite simple. As it is significantly lower than the desirable level of 1.0 (see the paragraph What is a good current ratio?), it is unlikely that Mama’s Burger will get the loan. Our team is ready to learn about your business and guide you to the right solution.

Your current liabilities (also called short-term obligations or short-term debt) are:

An analyst or investor seeing these numbers would need to investigate further to see what is causing the negative trend. It could be a sign that the company is taking on too much debt or that its cash balance is being depleted, either of xero for small business which could be a solvency issue if the trend worsens. The current ratio can be a useful measure of a company’s short-term solvency when it is placed in the context of what has been historically normal for the company and its peer group.

Create a Free Account and Ask Any Financial Question

If you are interested in corporate finance, you may also try our other useful calculators. Particularly interesting may be the return on equity calculator and the return on assets calculator. Be sure also to visit the Sortino ratio calculator that indicates the return of an investment considering its risk. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

A company’s current liabilities are the other critical component of the current ratio calculation. Analyzing the composition of a company’s current liabilities can provide insights into its ability to meet its short-term obligations. The current ratio measures a company’s liquidity, which refers to its ability to convert assets into cash quickly. A high current ratio indicates that a company has many liquid assets that can be used to pay off its short-term debts if necessary. It is important to note that the optimal current ratio can vary depending on the company’s industry.

Ultimately, the current ratio helps investors understand a company’s ability to cover its short-term debts with its current assets. However, it’s important to remember that the current ratio has limitations and must be interpreted in the context of a company’s specific circumstances and industry norms. The growth potential of the industry can affect a company’s current ratio.

English

English

Add Comment